The rise of cryptocurrency negotiation volume: unzipping the role of market activity

Like the first and most recognized cryptocurrency in the world, Bitcoin has revolutionized the way people think of money and negotiation. Over the years, there have emerged numerous other cryptocurrencies, each with its own unique resources and applications. A -chau aspect of these cryptocurrencies is the commercial volume – a vital indicator that reveals the level of market activity. In this article, we will delve deeper into the world of cryptocurrency negotiation volume, exploring its meaning and how it contributes to the general dynamics of the market.

What is negotiation volume?

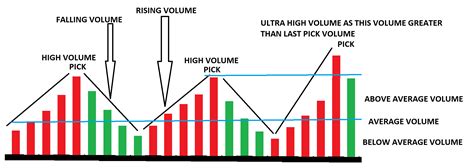

The negotiation volume refers to the total number of units (such as Bitcoin or Ethereum) negotiated for a specific period. It is measured in currency per unit, usually expressed in dollars or euros by bitcoin. This metric provides information on the activity of purchase and sale in the cryptocurrency market, offering valuable clues about market feeling.

Why is the volume of negotiations important?

The volume of negotiation serves several purposes:

- Feeling in the market : A high negotiation volume may indicate a strong demand for a specific cryptocurrency, suggesting that investors are optimistic about their perspectives.

- Price Movement

: Fluctuations in negotiating volume can influence the price of cryptocurrencies. Higher volumes usually lead to more aggressive price movements, while lower volumes can result in slower price changes.

- Risk Management : By monitoring the volume of negotiation, investors can evaluate their exposure to possible losses and adjust their strategies according to.

4.

Cryptocurrency Trading Volume Trends

The research consistently showed that cryptocurrency prices tend to follow trends in trading volume. Some remarkable standards include:

- Trend Correlation : higher negotiation volumes usually coincide with upward trends, while lower volumes may be associated with descending movements.

- Volume -driven Move : When the negotiation volume increases significantly, the price of a specific cryptocurrency tends to move faster and more frequently.

- Seasonality : Trading volume patterns may display seasonal variations, with higher levels of activities during growth periods or economic celebrations.

Case Studies: Specific Cryptocurrencies

Several cryptocurrencies have shown impressive negotiation volumes in recent years:

- Bitcoin (BTC) : As the first cryptocurrency, Bitcoin’s trading volume is always among the highest.

- Ethereum (ETH) : With its robust developer community and increasing adoption, Ethereum’s commercial volume showed significant growth.

- Ripple (XRP) : Ripple’s high volumes have contributed to their growing popularity as a payment network.

Conclusion

In conclusion, cryptocurrency negotiation volume is an essential aspect of the market that provides valuable information about market activity. By analyzing and interpreting negotiating volume trends, investors can better understand market sentiment, price movements, risk management strategies and the general dynamics of the market. As the most cryptocurrencies arise, it is essential to keep an eye on their commercial volumes to make informed investment decisions.

Recommendations

- Stay informed : Continuously monitor cryptocurrency news and market analysis to stay up to date with the latest developments.

- Diversify your portfolio : Spread your investments in various cryptocurrencies and asset classes to minimize risk.

- Defines negotiation strategies : Develop a well -thoughtful commercial plan, incorporating factors such as volume, order flow and market capitalization.