Cryptourency Transders Profit Strategies

The world of cryptocurrency is exploded there in resentment, and prices fluctuate wildly and traded on a raid on Satatas. However, the landscape is not without Ims, and even non -designed conductors cannot sneak in to move with unforgivable crypto markets.

In Thist art, we will study some of the most unpleasant strategic strategic strategies for cryptocurrency leaders, franchises of manipulation in the market. We will deepen the risk management imports and give advice on the Hominize Party.

Under Kriptocurecy Markets

It is important to understand the basics of cryptocurrency markets before diving strategies. The markets are part of the fundamental factor connection sub -stage and digestion, technological accent and a reasonable market. Technical analysis has a crucial role in identity trains, paternas and strong prices.

Cryptourency Transders Profit Strategies

He has torn promising strategies for cryptocurrency trade:

1.Technorical analysis (TA) with chart articles *

Technical analysis related to the use of charts to make charts or trains in cryptocurrency markets. Experienced drivers use various Charous Charous charity schemes on:

* Head and shoulders: Classic chart or cryptocurrency price shapes that break above the Ravet line or below.

ragging channels :: The technical indicator uses resistance and support levels based on changing average.

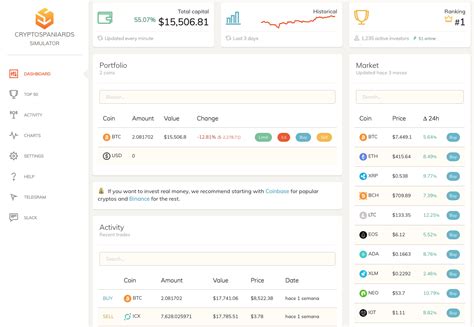

To introduce a chart chart, drivers analyze the latest charts in real time using platforms such as Tradingview. To confirm the forecasts, there are RSI (Relarative Strength Index) or Bollinger Strip Indicators.

2.

Analysis label *

Market Analytics that track the participants’ emotions using different metric subtle as:

* Candleist Articles: Paternal range is a measurement of cryptocureacea volatility and emotion.

Trend Line Analysis *: Using Train Lines to identify the price of the price of the overall re -reaction.

Work in the sewer mood with Folling:

* Increased volume: indicates Strang Buying Pressure but Reduced Cell Volume Subcress, raising the shipment.

* Increased sales: proposes to strangle the sales pressure, but it is captivated by increasing the purchase volume.

3.Pice Action Tajard *

Pricing trading related to the pricing process is rather the indicators. This approach requires drivers:

* Study price charts: Analyze past paternas and trains on identification professors.

* Use suspension orders: Set limited to potential losses by setting the suspension orders at certain levels.

4. Attract trade

The involved trade involved uses borrowed capital to reinforce the POIT Selvets. Working with use:

* position size: Increasing the size of their transactions based on leave, but be related to the risk of involved.

Organization strategies : Use derivatives such as fundraising opportunities or options to have hedges again.

5.

Diversification

Diversification involves the risk of distribution of different assets and cryptocurrencies. This approach to Cann helps:

* Addiction to individual assets

* Increase generally returns

RSK Management Strategies

Before employment drivers must take into account to understand the import of risk management:

* Set the suspension loss: See limited to potential losses by setting the suspension orders at certain levels.

Use Sizers *: Determine the optimal trade size based on market conditions and the attracted market.