Losing Treasures: Minimize the Risk in Crypto Crypto Trading

As the popularity of cryptocurrencies continues to grow, trading digital property has become demanding. Because prices are distinguished due to market forces, traders are increasingly looking for ways to manage and maximize. The successful strategy for minimizing rice is the use of a loss stop (SLO) in the cryptocurrency store.

What are the stop orders?

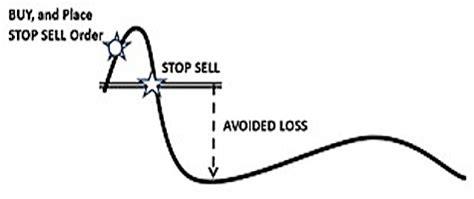

The loss stop order is the order of the type set with a broker and an exchange that interprets the topic on Asset in the property on the specification based on views. His goal. The goal of the slos is to limit the losses by closing the position of WEN that exceeds to a certain level and these limits potential losses.

Why are the loss of loss commands basically in the cryptocurrency store?

Cryptocurncy Marks can be unstable due to Varis as a brand as a brand, regulatory changes and exire events. Traders who do not use the stop of losing loss of losing the entire investment if it is complete. The slos helps the Hyk by providing an clipboard between the current level and the predetermined goal.

How to set up a loss stop order at the cryptocurrency store:

To set up a loss stop order, follow the steps:

- Select Broker or Exchange : Choose an Internet Broker Company that the Crypto Currency Currency.

- Create an account : Register for an account with Post -lu, and the Fund is sufficient capital.

- Place trading platform

: Download and install a trading platform on your device (eg Metatrader, TraringView).

- Set amarket or restriction or limit : use a trading platform to place the market or limit and for a cryptic currency. The chosen “stop loss” is as a type of order.

- PRONIK stop loss of precean and quaantity : Please specify the goal of the predication level (stop loss) and quantity (size position). Adjust the settings in accordance with the analysis of toleans and markets.

Best Practice to set up a stop order:

To maximize the efficiency of the slos:

- Use more orders with different stops : Place more SLO at variable prices price to Capturm range.

- Dynamically Adjust the loss of the loss of loss : Rebalacianance your position on the basis of the label and adjustment conditions

- Consider using the protection strategy : Combine the Slos -Aa that the second HISK management technique, SOch as a post with sucking or diversification, for additional protection.

Example uses the case:

Suppose you trade Bitcoin (BTC) with a broker, indicating the order feature to stop loss. You bought 100 BTC $ 10,000 each and want to set an order to stop the property if it will fall to $ 8,500. The cost of stopping the loss is $ 9,250 and the posts are 1/2 of your total position. With this setting:

- If the price of bitcoin drops to $ 7,900 (stop level), you will close the current post.

- You will avoid losing, the amovina reaches its goal ($ 8,500).

- The remaining exposure will be locked until the analysis further detects a potential purchase signal.

Conclusion:

Findings to stop losses are a key tool for merchants who want to reduce the risk and maximize profits in the crypto fire. By understanding your home Slos and implementing the best contracts, you can use the power to stop loss to move the movement of decay. Keep in mind that they are not approaching, as marketing conditions can quickly require continuous adjustment of your stop loss adjustment.